People

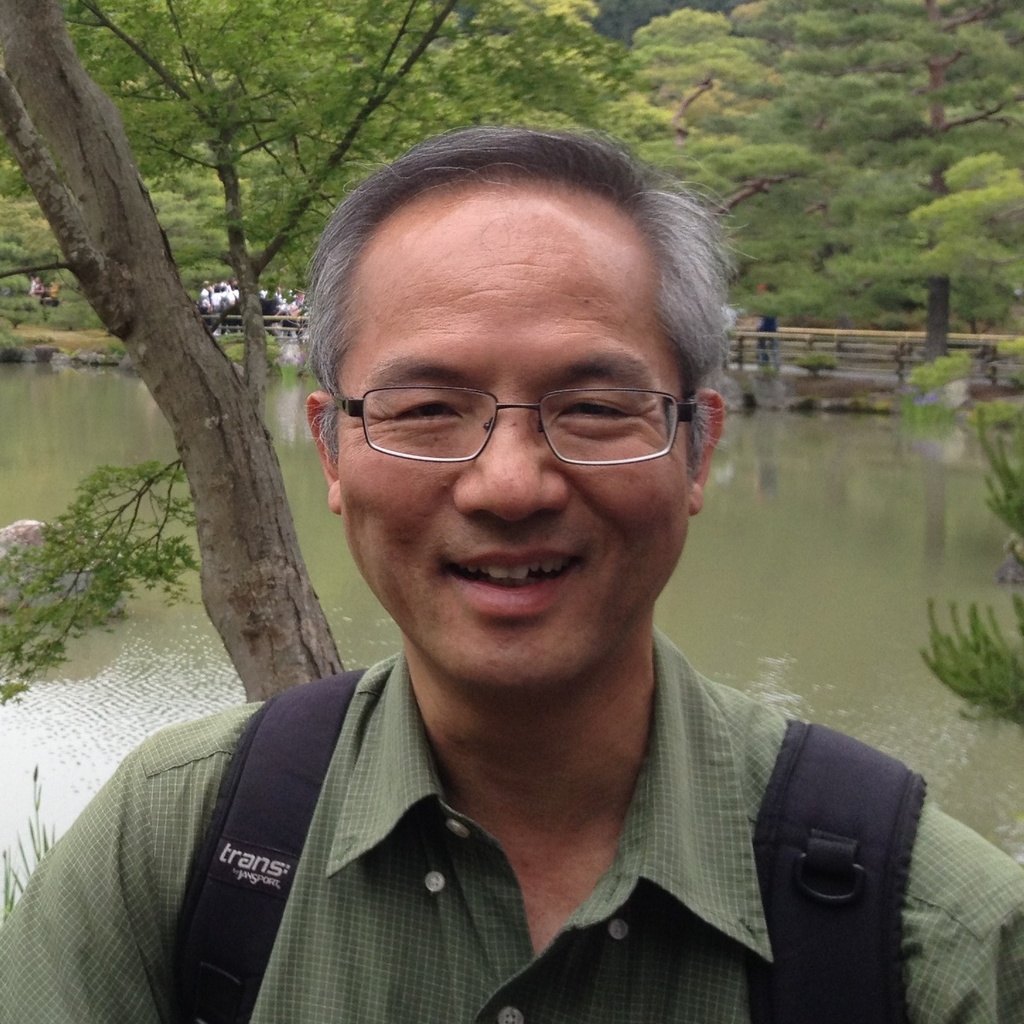

Kung-Sik Chan

Title/Position

Robert V. Hogg Professor

American Statistical Association Fellow

Institute of Mathematical Statistics Fellow

Kung-Sik Chan is a professor at the University of Iowa Department of Statistics and Actuarial Science.

Brian Bacher

Title/Position

IT Support Consultant

Brian Bacher is an IT support consultant for the Department of Statistics and Actuarial Science at the University of Iowa.

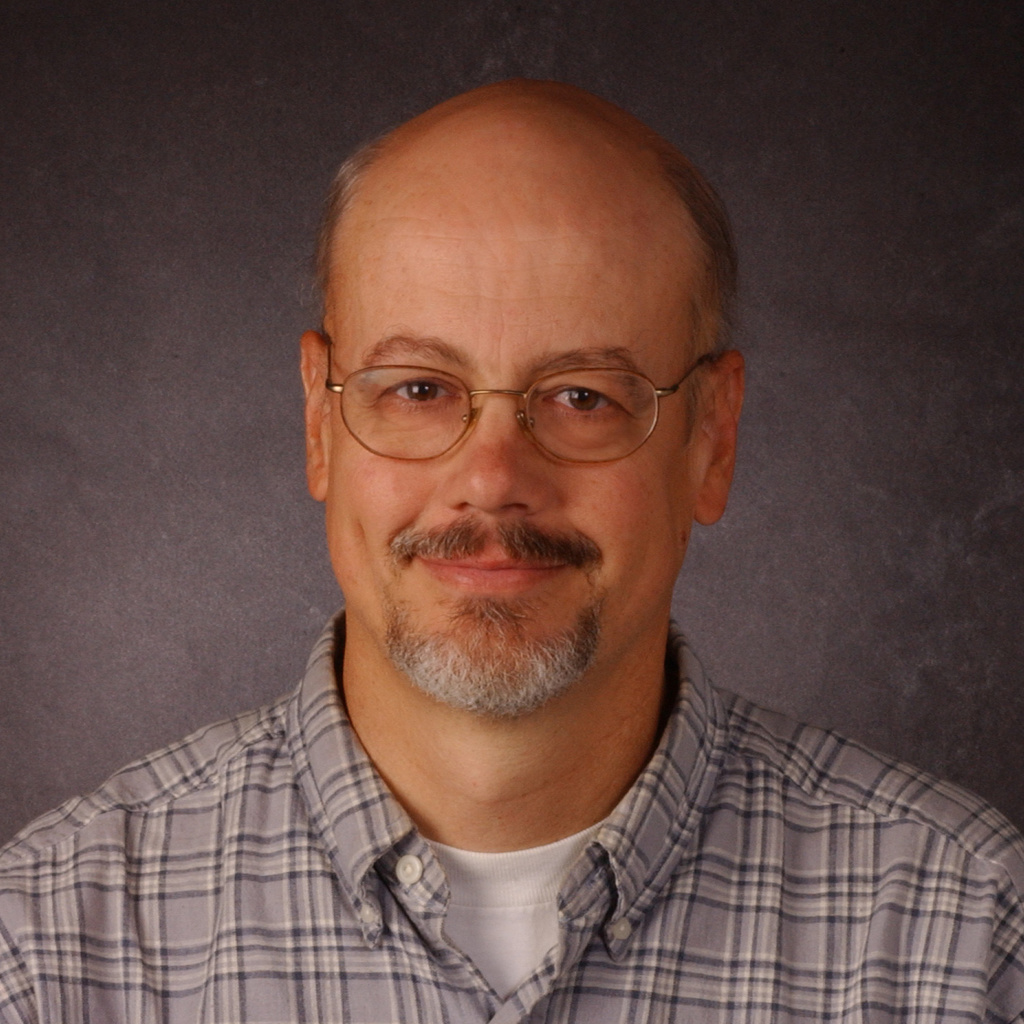

Matthew Bognar

Title/Position

Associate Professor of Instruction Emeritus

Matthew Bognar is an Associate Professor of Instruction at the University of Iowa Department of Statistics and Actuarial Science.

James D. Broffitt

Title/Position

Professor Emeritus

James D. Broffitt is a retired faculty member with the University of Iowa Department of Statistics and Actuarial Science.

Joe Cavanaugh

Title/Position

Courtesy Appointment

Professor

Department of Biostatistics Head

American Statistical Association Fellow

Joe Cavanaugh is a professor in the University of Iowa Department of Statistics and Actuarial Science.

Kate Cowles

Title/Position

Professor Emeritus

Kate Cowles is a retired faculty member with the University of Iowa Department of Statistics and Actuarial Science.

Paul R. Cox

Title/Position

Undergraduate Advisor

Paul R. Cox is an undergraduate advisor for the Department of Statistics and Actuarial Science at the University of Iowa.

Mackie Garrett

Title/Position

Academic Advisor

Joyee Ghosh

Title/Position

Associate Professor

Joyee Ghosh is an associate professor in the University of Iowa Department of Statistics and Actuarial Science.

Barbara Hogg

Title/Position

Adjunct Instructor

Fellow, Society of Actuaries

Jian Huang

Title/Position

Professor Emeritus

American Statistical Association Fellow

Jian Huang is a retired faculty member in the University of Iowa Department of Statistics and Actuarial Science.

Anna Kelly

Title/Position

Administrative Services Manager

Anna Kelly is a Department Services Manager for the Department of Statistics and Actuarial Science at the University of Iowa.

Emma Kirk-Alvarez

Title/Position

Associate Director, CLAS Advising Network

Emma Alvarez-Kirk is an undergraduate advisor for statistics and actuarial science at the University of Iowa.

Joseph B. Lang

Title/Position

Professor

American Statistical Association Fellow

Joseph B. Lang is a professor in the University of Iowa Department of Statistics and Actuarial Science.

Russell V. Lenth

Title/Position

Professor Emeritus

American Statistical Association Fellow

Russell V. Lenth is a retired faculty member in the University of Iowa Department of Statistics and Actuarial Science.

Erning Li

Title/Position

Associate Professor of Instruction

Erning Li is an associate professor of instruction in the University of Iowa Department of Statistics and Actuarial Science.

Alex Liebrecht

Title/Position

Assistant Professor of Instruction

Alex Liebrecht is a lecturer in the University of Iowa Department of Statistics and Actuarial Science.

Heather Roth

Title/Position

Administrative Services Coordinator

Heather Roth is an administrative services coordinator in the Department of Statistics and Actuarial Sciences at the University of Iowa.

Mary Russo

Title/Position

Lecturer Emeritus

Mary Russo is a retired lecturer with the University of Iowa Department of Statistics and Actuarial Science.

Ralph P. Russo

Title/Position

Professor Emeritus

Ralph P. Russo is a retired faculty member with the University of Iowa Department of Statistics and Actuarial Science.

Elias S.W. Shiu

Title/Position

Professor

Collegiate Fellow

Director of Undergraduate Studies, Actuarial Science

Elias S.W. Shiu is a professor in the University of Iowa Department of Statistics and Actuarial Science.

Nariankadu D. Shyamalkumar

Title/Position

Associate Professor

Nariankadu D. Shyamalkumar is an associate professor in the University of Iowa Department of Statistics and Actuarial Science.

Tammy Siegel

Title/Position

Administrative Services Specialist

Tammy Siegel is a Department Services Specialist for the Department of Statistics and Actuarial Science at the University of Iowa.

Sanvesh Srivastava

Title/Position

Associate Professor

Director of Undergraduate Studies, Data Science and Statistics

Sanvesh Srivastava is an associate professor in the the University of Iowa Department of Statistics and Actuarial Science.

Osnat Stramer

Title/Position

Associate Professor

Osnat Stramer is an associate professor in the University of Iowa Department of Statistics and Actuarial Science.

Aixin Tan

Title/Position

Associate Professor

Aixin Tan is a faculty member with the University of Iowa Department of Statistics and Actuarial Science.

Andrew M. Thomas

Title/Position

Assistant Professor

Andrew Thomas is a faculty member with the University of Iowa Department of Statistics and Actuarial Science.

Luke Tierney

Title/Position

Professor

Ralph E. Wareham Professor of Mathematical Sciences

American Statistical Association Fellow

Institute of Mathematical Statistics Fellow

Luke Tierney is a faculty member with the University of Iowa Department of Statistics and Actuarial Science.

Josh Zhiwei Tong

Title/Position

Assistant Professor

Josh Zhiwei Tong is a faculty member with the University of Iowa Department of Statistics and Actuarial Science.

Pagination